Concerning Mental Health Levels Place Ireland at Bottom of EU Rankings

Laya healthcare, part of AXA draws insights from the Global AXA Mind Health report to benchmark Ireland’s mental health.

Laya healthcare, leveraging the global insights of the annual AXA Mind Health Report, today launched the Irish results which reveals concerning mental health statistics in Ireland. The extensive study highlights that 48% of the Irish population reported they are struggling or languishing—a state marked by a lack of vitality, zest, and a pervasive feeling of stagnation. Ireland has the lowest average score in relation to Mind Health Index among the nine European countries surveyed*. Switzerland reports significantly better mental health outcomes as the highest scoring EU country where 37% are struggling or languishing.

The report, based on insights from 17,000 participants across 16 countries, underscores that mental health remains a top priority worldwide, with one in three individuals experiencing at least one mental health condition (32%). As the leading Health & Wellbeing provider in Ireland, laya healthcare, now part of AXA, can benchmark Irish mental health against this global data and trends for the first time.

According to the Depression, Anxiety and Stress Scale (DASS), in Ireland, 75% of adults are potentially facing mental health difficulties, affected by anxiety, stress or depression even mildly, compared to the EU average (69%). Young Irish adults are particularly vulnerable, 43% of those aged 18-24 and 44% of those aged 25-34 are potentially affected by severe or more extreme levels of depression, anxiety, or stress.

Key Findings: Ireland's Mental Health at a Glance

- Digital Reliance: Young adults are increasingly using digital sources for mental health information. Over half (57%) of 18–24-year-olds use AI apps, and 41% of 25-34 year olds do the same. This, coupled with the fact that nearly a quarter (24%) of Irish respondents use social media for mental health information raises serious concerns about misinformation, delayed access to professional care, and the overall impact of unverified digital sources.

- Workplace Stressors: A significant 51% of Irish professionals cite their salary level as negatively impacting their mental wellbeing, reflecting concerns about financial security and the cost of living. Ireland ranks 6th within EU countries in the report for salary level impacting mental health. Workload and deadlines also contribute to mental health challenges for 48% of workers.

- Sick Leave Impact: 31% of Irish working population have taken sick leave due to mental or psychological health issues in the past year, highlighting the impact of mental wellbeing on workforce productivity. Ireland scored second highest out of the EU countries surveyed for sick leave, with Turkey ranking first (43%) and Belgium ranking third (30%).

- Mirroring global trends: A significant 78% of Irish respondents report that multiple factors are negatively impacting their mental health, indicating the complexity of the challenges they face. The top five factors impacting mental health in Ireland mirror those seen globally: uncertainty about the future (56%), financial instability and job insecurity (55%), constant exposure to negative news (48%), loneliness (44%), and social and political unrest (39%).

Nicole Paulie, Chartered Counselling Psychologist and Clinical Lead at laya healthcare’s 24/7 Wellbeing Support Programme (MWSP), commented: “The AXA Mind Health report mirrors the laya healthcare Workplace Wellbeing research over the last five years, highlighting the growing mental health needs of adults in Ireland. Understanding these needs and challenges is crucial for providing effective, immediate support and promoting long-term wellbeing.”

Irish Employees Face Significant Workplace Stress

A substantial 78% of Irish employees report at least one impact of workplace stress in their daily lives. Common issues include difficulty sleeping (40%), increased irritability and mood swings (34%), and physical symptoms like headaches (34%). Workplace stress also impacts employers in the workplace, with 30% of employees experiencing decreased motivation and productivity, and 10% reporting increased absenteeism or lateness.

Addressing the growing need for mental health support, Erika O’Leary, Director of People, Culture and Legal at laya healthcare, states: "Having access to a report like this provides valuable insights into the key factors impacting mental wellbeing in Ireland, including workplace stress. As leaders in this space, we are excited to leverage these insights to enhance our innovative solutions and resources, supporting individuals and organizations in building a more resilient and mentally healthy society."

Supports and Self-Management

The substantial Mind Health report reveals that 43% of Irish individuals that currently suffer from a mental health condition seek professional mental health support, while 41% actively self-manage their conditions. This is compared the European average of 46% seeking professional help and 35% self-managing. Healthcare professionals are the leading source of information (57%), followed by online resources (44%) and family and friends (36%).

Laya healthcare's data from 2024 mirrors this trend as it shows almost 25,000 interactions (24,714) with its immediate and confidential support benefit, the 24/7 Mental Wellbeing Support Programme (MWSP), averaging almost 65 interactions a day.

Dr. Imren Sterno, Lead Consultant Clinical Psychologist at AXA Health, added: "Examining mental health on a global scale provides valuable insights into the factors influencing wellbeing and emerging trends. Understanding these trends allows us to develop effective strategies to support individuals and communities.”

Explore the findings and the full report at www.layahealthcare.ie/mind-health/

Laya Healthcare Appoints Dr. Olwyn McWeeney as Director of Medical Services

20th March 2025

Laya Healthcare, now part of AXA, has appointed Dr. Olwyn McWeeney to its Executive Leadership Team as Director of Medical Services, a newly created role pivotal to the company’s ambitious healthcare strategy.

A highly respected clinician, Dr. McWeeney brings a wealth of experience as a Medical Doctor, Barrister, Senior Healthcare Executive, and former founding CEO and Medical Director of the Galway Clinic. Her appointment marks laya healthcare’s first external Executive hire in over a decade, reinforcing its commitment to expanding healthcare delivery and enhancing clinical excellence for its 710,000 members.

In her new role, Dr. McWeeney will drive laya’s Medical Services strategy, ensuring best-in-class care across its network of Laya Health & Wellbeing Clinics, digital health platforms, and telehealth services. She will focus on clinical outcomes, innovation, and strengthening laya’s healthcare offering to meet evolving member needs.

D.O. O’Connor, Managing Director at Laya Healthcare, welcomed the appointment:

“Delivering faster access to healthcare is key to delivering on our promise to look after our members always and we’re beyond thrilled to have someone of Olwyn’s distinguished calibre and experience join our team and take us to the next level of healthcare that will deliver better medical outcomes for our members.”

Dr. McWeeney added:

“Laya’s drive for innovation and deep commitment to superior levels of patient-centric care in an ever-evolving healthcare landscape is inspiring. With a focus on integration, innovation and enhancement of laya’s medical services, this exciting role will augment laya’s continuous efforts to deliver a seamless and sustainable healthcare experience for members now and into the future. With the support of an experienced and passionate team, my role is to integrate and enhance laya healthcare’s benefits and services, aligning them with our ambitious plans to redefine healthcare delivery and drive better outcomes for members. I am delighted to join the laya team.”

Laya Healthcare is part of AXA Group, Europe’s No.1 health insurer and a global leader in healthcare.

About Dr. McWeeney, MB BCH BAO LLB BL

Dr. McWeeney is a distinguished Medical Doctor, Barrister-at-Law, and Senior Healthcare Executive with over 20 years of experience spanning public and private healthcare, life sciences, and medico-legal sectors. She holds an Honorary Lectureship with Royal College of Surgeons Ireland (RCSI).

Her previous roles include:

- Assistant National Director, HSE

- CEO & Medical Director , Galway Clinic

- Health Systems & Life Sciences Consultant, IQVIA

Dr. McWeeney holds an Honours Degree in Medicine and a First-Class Honours Degree in Law from University of Galway, a Barrister-at-Law Degree from King’s Inns, and a Strategy Execution Certification from Harvard Business School.

One in Five Workers Struggling with Substance Use

Laya Healthcare's Workplace Wellbeing Index Reveals One in Five Workers Struggling with Substance Use

Data Uncovers Extent of Addiction, Mental Health Concerns, and Shifting Work Trends in Ireland

A concerning trend has emerged in Irish workplaces: one in five workers are struggling with illegal substance use, according to the latest laya healthcare Workplace Wellbeing Index. Launched today at Croke Park, Dublin, this comprehensive annual report, now in its fifth year, provides crucial insights into the evolving landscape of employee wellbeing in Ireland. Business leaders are invited to attend a free virtual summit on November 12th, featuring expert speakers Dr. Sumi Dunne, Brian Pennie, and Brendan Courtney, to delve deeper into these critical issues.

The 2024 Index reveals that 16% of employees are addicted to or have an unhealthy relationship with Class A or illicit drugs. Overall, two in five Irish workers report addiction to or an unhealthy relationship with at least one substance, with nicotine (29%) and alcohol (21%) being the most prevalent.

The data shows that men, those aged 24 and under, and those with a disability or health condition are more likely to struggle with addiction. Concerningly, senior managers are also more likely to report unhealthy relationships with substances compared to those in more junior roles.

Beyond substance use, the Index highlights the growing prevalence of other addictions impacting the workplace. Almost a third of workers (33%) admit to an unhealthy relationship with social media, while 30% report the same about work itself. One in five respondents identify similar struggles with pornography or sex, mirroring the figure (19%) for gambling addiction.

Sinéad Proos, Head of Health & Wellbeing at Laya Healthcare, commented on the findings: “Employers should recognise addiction as a serious issue impacting Irish workplaces, encompassing substance use, gambling, and social media. While these results are concerning, they also present a valuable opportunity for employers to prioritise employee wellbeing. By fostering a supportive culture and providing access to resources like counselling and employee assistance programs, we can support and empower employees to make the first steps towards improving their health and wellbeing.”

Health Conditions, Disabilities, and Disclosure in the Workplace

The Index also sheds light on the prevalence of health conditions and disabilities among Irish workers. A significant one in two employees report living with an underlying health condition or mental wellbeing issue. Anxiety and depression are the most commonly cited conditions, with one in ten Irish employees having a diagnosis of depression.

Concerningly, the data reveals a disconnect between employees and their organizations regarding these issues. 54% of those with a health condition or disability admit they would be embarrassed to speak to their employer about it, while one in two with a mental health condition fear being treated differently if they disclose it to their employer. Furthermore, nearly half of all employees (48%) are unaware of the support resources available to them.

The Index highlights the disparity in diagnosis rates between physical and mental health conditions. People with physical conditions are more likely to have a formal diagnosis than those with mental health or communication difficulties. For example, while most people with a visual or hearing impairment have been diagnosed, the rates are significantly lower for anxiety and speech and language problems.

Sinéad Proos emphasized the need for improved communication: “Employers and employees need to communicate more openly about health conditions and disabilities. Not having a diagnosis or feeling unable to discuss needed support can cause unnecessary stress and hardship for team members. It’s crucial that organisations prioritise clear communication about health and wellbeing resources, making them easily accessible so employees can get the support they deserve.”

Neurodiversity in the Workplace

The Index also explored the topic of neurodiversity, with 15% of employees reporting that they live with a neurodiverse condition. ADHD (Attention Deficit Hyperactivity Disorder) is the most common, affecting 7% of respondents, followed by autism (4%) and dyslexia (3%). However, many neurodiverse employees lack a formal diagnosis, with only 43% of those with autism, 39% with ADHD, and 49% with dyslexia having received an official diagnosis. The data also indicates a reluctance to disclose neurodiversity in the workplace, with less than half of employees with these conditions informing their employers.

Shifting Trends in Ways of Working

The Index highlights a clear trend towards hybrid and fully on-site working models. Only 10% of employees now work remotely full-time, compared to 26% working hybrid and 64% working on-site full-time. Half of HR respondents reported increasing the number of office-based days in the last year, citing positive impacts on productivity (52%), collaboration (50%), and staff wellbeing (41%).

However, the "always on" culture persists for many employees, with 37% regularly contacted outside of work hours via email, WhatsApp on personal numbers, and personal phones. This highlights the ongoing challenge of maintaining work-life balance, despite the "right to disconnect" legislation.

Laya healthcare is the number one health and wellbeing provider with over 2,500 wellbeing programmes and over 2,000 corporate clients nationwide. For more information on laya healthcare’s Workplace Wellbeing Index 2024, and to register for the launch of the laya healthcare Workplace Wellbeing Index 2025 virtual event taking place on Tuesday 12th November at 9.30am – 12pm visit https://www.layahealthcare.ie/wellbeingindex

Loneliness: A Significant Issue for Nearly Half of Irish Adults, Especially Young People, Yet Sport Offers a Beacon of Hope

- 8 million Irish adults experiencing loneliness*

- Loneliness is leading to lower self-esteem and increased levels of depression and anxiety.

- Sport is a ‘powerful antidote’ to this issue, says leading psychologist.

A new laya healthcare study reveals a stark reality: loneliness is pervasive in Ireland, impacting nearly half of adults and disproportionately affecting young people. To address this, laya healthcare has launched a campaign to raise awareness and promote sport, specifically rugby, as a way to help. Connacht Rugby, Leinster Rugby, and Munster Rugby are working with laya healthcare to try and combat the issue.

The research revealed a staggering 93% of people believe loneliness is a problem, with 1.8 million adults experiencing it. Almost 6 in 10 people (59%) report feeling lonely at least monthly, highlighting the widespread nature of this issue.

While loneliness affects all ages, younger generations are bearing the brunt. Those under 44 report feeling lonelier than older demographics, shattering the stereotype of loneliness primarily affecting seniors. Nearly 1 in 5 young adults experience severe loneliness, making them the loneliest age group. This vulnerability stems from various factors, with 44% feeling disconnected from those around them, 42% lacking sufficient friends and family, and 39% lacking social activities.

Impact on wellbeing

The study also reveals the concerning impact of loneliness on both mental and physical wellbeing. Over half (52%) of those experiencing loneliness report lower self-esteem, while 50% experience increased depression and anxiety. Worryingly, 23% report that loneliness negatively impacts their physical health, highlighting the far-reaching consequences of this issue.

Rugby a ‘powerful antidote’

Despite the startling stats above, the research also offers a beacon of hope: the power of sport, particularly rugby, to combat loneliness and foster connection. With 87% of the Irish population following at least one sport, and rugby ranking among the top three, its potential to address loneliness is significant. The majority of respondents (85%) agree that sport can combat loneliness, with 79% specifically highlighting rugby's positive impact.

Speaking about the campaign, Kevin Kent, Head of Marketing and Consumer Sales at laya healthcare, states, "As the Official Health and Wellbeing partner of Connacht, Leinster, and Munster Rugby, laya healthcare is committed to tackling loneliness in Ireland. Through the ‘We are one. Always’ programme, we aim to inform, educate, and connect communities, leveraging rugby’s community spirit to support those affected. We are proud to work with the three provinces on this important societal issue, with on field rivalry being put aside to support those in need”.

Laya healthcare has also collaborated with academic psychologist Dr. Joanna McHugh Power to develop three informative papers on loneliness, offering guidance for those affected. To foster connection, laya healthcare will distribute hundreds of game tickets throughout the season, starting with Christmas fixtures, and plan more initiatives for the new year.

Dr. Joanna McHugh Power, emphasises, "This research reaffirms what we as psychologists see every day: social connection is crucial for mental wellbeing. It’s not about being in a room with people; it’s about feeling seen, heard and understood. By offering a sustainable context for social connection, team sports such as rugby, with its inherent team spirit, camaraderie, and strong community ties, may provide a valuable way to reduce or prevent loneliness. This could be incredibly valuable in supporting mental health and fostering overall wellbeing”.

This positive association is reflected in the data, with rugby fans significantly less likely to experience loneliness on the UCLA Loneliness Scale. The UCLA (University of California, Los Angeles) Loneliness Scale was developed by researchers in the field of psychology in 1978 and is used by clinical experts and is the most commonly used measure of loneliness worldwide.

Almost three quarters (73%) of rugby fans feel a sense of companionship and togetherness with other supporters, highlighting the power of shared passion in fostering connection. This translates to increased happiness, with 67% of rugby fans reporting feeling "happy" compared to 60% of non-rugby fans. Furthermore, adults who currently play or have played rugby are more likely to be satisfied with their number of friends (38% vs. 18% of non-players), demonstrating the long-term benefits of the sport's community aspect.

For more information on the campaign, visit www.layahealthcare.ie/weareone

Medical Scan Delays Linked to Negative Health Outcomes for 77% of Irish Patients

New research* reveals a concerning trend in Ireland: lengthy wait times for diagnostic imaging scans are taking a toll on patients' health and well-being. A staggering 77% of those surveyed who experienced delays reported negative consequences for their treatment and overall well-being.

The study, commissioned by laya healthcare, found that 31% of people have waited too long for a scan in the past 24 months. These delays are fuelling anxiety, with 49% of respondents feeling anxious while waiting for scans, and 16% reporting severe anxiety. The research also highlighted the prevalence of prolonged wait times, with 23% waiting over a month for a scan and 12% facing similar delays for results.

In response to these issues, laya healthcare has committed to improving access to diagnostics for all and now offers fast access to diagnostic imaging scans with results in just two days in all Laya Health and Wellbeing Clinics nationwide.

Key Insights from research:

- Extended wait times: Nearly half (46%) of people waited over two weeks for a scan, with 23% waiting over a month.

- Regional disparities: Wait times vary across the country, with 26% of people in Munster and the rest of Leinster waiting over a month for scans, compared to 20% in Dublin, Connaught, and Ulster.

- Delayed results: Over half (51%) of people waited over seven days for their scan results, with 29% receiving results up to two weeks later and 12% waiting up to a month. 4% of respondents never received any results from their scan.

- Spending revealed: The average spend on scans in the past 24 months was €192, with 30% of people spending over €200 on scans and 16% spending over €400.

Adding to the stress, almost half of those surveyed (49%) turned to the internet to self-diagnose while waiting, with the majority relying on Google (86%). Worryingly, only 1 in 10 considered the information they found online to be completely accurate.

"No one should have to endure weeks or months of anxiety and uncertainty waiting for a scan," said John McCall, Director of Claims and Provider Relations at laya healthcare. "We're committed to providing faster access to diagnostics, enabling quicker diagnoses and treatment plans so people can get back to their lives."

Laya healthcare has recently opened a new Laya Health & Wellbeing Clinic in Cork and expanded the state-of-the-art Laya Health & Wellbeing Clinic in Cherrywood in Dublin making it the fastest growing urgent care network in Ireland. Laya healthcare is now part of AXA insurance, the number one insurer in Ireland and the number one health insurer in Europe.

Laya Super Troopers celebrates 10 years of empowering one million Irish children to lead healthier lives.

Participants report significant improvements in wellbeing, exercise and eating habits.

Laya Super Troopers, laya healthcare’s health homework programme, is marking its 10th anniversary with a resounding message of success. Over the past decade, the initiative has reached over one million primary school children and their families across Ireland, inspiring them to embrace healthier habits and build a foundation for a brighter future.

Ireland’s first ever health homework programme, Laya Super Troopers was launched in 2014 and has been developed with teachers and experts focusing on three core pillars - mental wellbeing, physical activity and nutrition. The free programme is designed for the primary schools of Ireland and teachers, children and families are encouraged to adopt healthy habits and take part in daily and weekly challenges.

Laya Super Troopers Ambassador Johnny Sexton spoke about why he got involved with the programme and how his family have adopted some of the healthy habits “Being a Dad has opened my eyes to the importance of getting active as a family. I’m a huge fan of Laya Super Troopers, it’s such a clever way to get kids more active with their families. Involving teachers in overseeing the health homework aspect of Super Troopers is an integral part of the Programme and that’s really clever because we all know how conscientious parents are to make sure that homework is done and signed off on. I’ve already introduced my kids to some of the activities and they love them, it makes getting active together easy and fun.”

As Laya Super Troopers marks its 10-year milestone, the proof is in the data as the results show the significant positive impact of Laya Super Troopers on participating children.

The research[1], conducted with primary school children in Munster and Leinster who took part in the Laya Super Troopers programme, points to positive changes:

- Exercise is on the rise: The number of children engaging in physical activity six or more days a week has jumped from 37% to 41%, while those who were physically active four or more days a week increased from 74% to 79%.

- Girls are leading the charge: A remarkable improvement was seen in girls' exercise levels, with those exercising four or more days a week soaring from 70% to 81%.

- Healthy choices are becoming the norm: Children are making smarter snacking decisions, with those opting for healthy snacks 'always' or 'often' increasing from 43% to 47%. Meanwhile, those who ‘rarely’ or ‘never’ choose a healthy snack dropped from 11% to 8%.

- Wellbeing is flourishing: The programme has had a profound impact on children's mental wellbeing, with those reporting feeling calm and relaxed 'often' or 'always' rising significantly from 48% to 56%.

Reacting to the results, Sinead Proos, Head of Health and Wellbeing at laya healthcare, said: “With marked improvements in exercise, nutrition and wellbeing, the data clearly shows that Laya Super Troopers makes a compelling difference for the kids who take part. We can see from the data that the programme really works to encourage healthy behaviours in our children. Laya Super Troopers is fun, has proven results and is completely free so I would encourage every school to register for the year ahead.”

How to sign up

Laya Super Troopers is easy to get involved in and free for all schools. Simply visit www.layahealthcare.ie/supertroopers to register your school’s interest to participate and all materials will be provided free of charge. Participating schools and families receive Laya Super Trooper activity family wallcharts, a teacher’s guide to the programme, Laya Super Troopers prizes and much more including a chance to win a sports experience from one of laya healthcare's sports partnerships with Connacht, Leinster and Munster Rugby.

About Laya Super Troopers:

Laya Super Troopers was launched in 2014 to encourage children and their families to become more active and learn about healthy lifestyles. Since its inception, there have been over 8,000 school registrations for Laya Super Troopers, with over one million children taking part.

[1] Research was carried out by Real Nation

D.O. O’Connor appointed as new Managing Director of laya healthcare

The Chief Executive of AXA Ireland, Ms. Marguerite Brosnan, today announced the appointment of D.O. O’Connor as Managing Director designate of laya Healthcare (laya). The appointment is subject to regulatory approval. Subject to that approval, the appointment will commence from the 1st January 2025.

AXA Ireland completed the €650m acquisition of laya healthcare in November 2023. AXA will begin to underwrite laya policies on renewal from 1st January next.

In his new role, Mr. O’Connor will lead laya healthcare’s ongoing growth and development overseeing a team of 670 and a membership base of over 705,000 people.

Mr. O’Connor is currently Deputy Managing Director of laya healthcare. He is one of the company’s longest serving executive directors having joined the business in 1996. He will succeed Mr. Dónal Clancy who has been MD of laya since its establishment in 2012. Mr. Clancy will remain with AXA in a new role as Executive Advisor. In this role, Dónal will provide advice and guidance on the medium-to-long term strategy for developing the health business in Ireland. Dónal will also support the team to embed the processes that have been put in place to manage the health business.

Ms. Brosnan has also announced the appointment of Eoin O’Neill as Health Director (also subject to regulatory approval). Mr. O’Neill joins from Swiss Re where he was Director and Country Head for Ireland. In his new role, Mr. O’Neill will have overall responsibility for health underwriting and pricing strategy.

Commenting on the appointments, Marguerite Brosnan, CEO of AXA Ireland said;

“These appointments are a very positive step in our journey to integrate laya healthcare and health into our overall offering. AXA is the No.1 insurer in Ireland and the No.1 Health Insurer in Europe with over €20bn in revenues globally[1]. With those strong foundations in place, our ambition in Ireland is to evolve our business and consolidate the products we offer around the needs of our customers in the health, retail and commercial insurance sectors”

Speaking on his appointment,, D.O. O’Connor said,

“I’m lucky to be taking the reins at a time of positive change and opportunity at laya healthcare and it’s the privilege of my career to lead such a strong-performing team and business. Now part of AXA, the future is bright for us at laya and I’m excited to lead our members, our team and our partners into the next chapter of growth and opportunity. Looking after our members always is the promise we made back when we first launched laya and that remains the North Star that will guide our continued growth and ambition. I’d personally like to thank Dónal for over 25 years of unwavering support, friendship and incredible leadership. While it’s impossible to replace his like, he has helped create a culture of performance and inclusion that I am committed to continuing with the support of the team.”

Outgoing MD, Dónal Clancy said

“When AXA Ireland acquired laya last year, I knew it was a momentous turning point for the team and business. AXA brings huge expertise backed by unrivalled scale and ambition and I’m excited to take on this new role to unite AXA and laya more closely and to help realise our vision to unlock the future of healthcare for our members. It’s been an enormous privilege to lead such a wonderful team and business at laya healthcare and I’m delighted to be handing over the reins to D.O. who has been an incredible support and friend to me over the last 25 years. I know he will lead the team and business with great confidence and vision into the next phase of growth and success.”

[1] FY2023 Earnings

Seven in ten women expect employers to have a menopause leave policy in place

Seven in ten women expect their employer to have a menopause policy in place but only 18% do

The laya healthcare Workplace Wellbeing Index reports

- Seven in ten women expect employers to have a menopause leave policy in place

- One in three HR leaders claim their company offers menopause leave

- Almost half of women look for fertility supports when job searching

Now more than ever, employees are placing greater importance on access to menopause supports within their organisations (and not just women of menopause age). The biggest increase in importance this year comes from men, reflective of the wider conversation and de-stigmatisation of menopause, with 50% noting the importance of a menopause policy when looking for a new job.

Results showed that both men and women feel that menopause supports are important for employers to provide, an increase from 10% last year to 13% now. Seven in ten women say it’s important to have a menopause policy in place (with 56% of men of the same opinion) and 56% say that it is a significant factor when searching for a new job.

Interestingly, 36% of HR leaders said that their organisation offers menopause leave while only 16% of employees noted the same. This gap showcases the need for organisations to raise awareness of this important service.

Of a similar vein, fertility supports are of significant importance for both men (47%) and women (49%) when looking for a new job. Females questioned did place a slightly higher importance on miscarriage, baby loss leave, fertility and surrogacy leave. The results showed that more availability and indeed awareness of availability of these services is required – an important note for HR leaders.

Commenting on the research findings, Sinead Proos, Head of Health & Wellbeing at laya healthcare said,

A point of interest from the research is that issues surrounding women’s health have become much more prevalent for their male counterparts. Despite this, we know that women continue to carry the burden with the data showing that more women are working while sick and struggling with sleep

While more and more companies look to be introducing assistance, employees need to be made aware of the supports on offer; these could include additional leave as required, access to virtual GP’s and counselling or other mental health supports.

I encourage HR leaders to download the supporting playbooks providing greater insight and suggestions of how to tackle the issues raised available at layahealthcare.ie/wellbeingindex.

Dr Sumi Dunne, GP & Clinical Lecturer adds

The data is encouraging. It is hugely positive to see the increased calls for supports from both male and female employees and indeed to see a changing landscape in terms of supports for menopause, fertility and other experiences which can have a detrimental effect on a persons’ wellbeing. I hugely encourage open dialogue around these topics in the workplace, paving the way for a shift in thinking and a greater understanding of the journey that someone may be on.

Laya healthcare is helping employers stay a beat ahead by supporting their employee’s mental health through the Workplace Wellbeing Index, one of Ireland’s largest studies among Irish employees and employers in the workplace. The full Workplace Wellbeing Index report, supporting playbooks and indeed speaker series to support a healthy workforce, can be downloaded / viewed at layahealthcare.ie/wellbeingindex.

Laya healthcare opens second Laya Health and Wellbeing clinic in Dublin

New 25,000 sq ft clinic to open in Swords resulting in 25 new jobs

Laya healthcare today announced the launch of a new Laya Health & Wellbeing Clinic in Swords Business Campus, Swords, Co Dublin. This will increase the nationwide network of Laya Health and Wellbeing Clinics to four and add an additional clinic to the Dublin area making it the fastest growing urgent care network in Ireland.

The North Dublin clinic will offer a range of health and wellbeing services including walk-in urgent care for the treatment of minor injuries and illnesses where patients as young as 12 months+ will be seen within 60 minutes - available to laya healthcare members and non-members. All Laya Health and Wellbeing Clinics have diagnostic imaging on-site continuing laya healthcare’s promise to improve access and ensure the current and future healthcare needs of members. The Laya Health and Wellbeing Clinic in Swords will provide X-Ray, MRI, Ultrasound and Dexa scan.

The investment of over €3million in the opening of this brand-new Laya Health and Wellbeing Clinic in North Co. Dublin will result in a new 25,000 sq ft clinic which will treat approximately 30,000 patients annually. As part of the expansion, 25 new jobs will be created including clinical and administrative teams. As with all Laya Health and Wellbeing clinics, it will be open 365 days per year from 10am – 10pm.

This clinic opening continues laya healthcare’s expansion and investment in its clinics since the first clinic opening in 2019, providing better healthcare access for members. Laya healthcare has seen an increased demand for the clinics year on year and in the past year alone footfall has increased by over 50%, with minor injuries being the highest reason for clinic presentations. The demand for this new Laya Health & Wellbeing Clinic is expected to be high due to the growing population of over 40,000 in Swords, and the fact that many from surrounding areas are likely to travel for the prompt service rather than presenting in busy A&E departments for lengthy periods.

The new clinic will provide;

- Access to the right care at the right time and Consultant-led urgent care for minor injuries and illness available to members and non-members alike – be seen within 60 minutes with the average out of pocket cost for members of €40

- A dedicated wellbeing space for the range of wellbeing services including Physio, HeartBeat (available to members over the age of 12) and HealthCoach (available to members over the age of 18) screening programmes with further plans for preventative health screening to be announced in 2024 (available exclusively to laya healthcare members)

- Faster access to world class diagnostic imaging including MRI, X-Ray, Dexa Scan, and Ultrasound

- For maximum ease and convenience, patients can be directly referred to an Orthopaedic Consultant in the Fracture Clinic located in the clinic for follow up patient care.

Commenting on the major investment and expansion of the Laya Health and Wellbeing clinic network, John Mc Call, Director of Claims and Provider Relations said;

“Today is a momentous day as we mark the significant investment of €3million in our Laya Health and Wellbeing Clinics, which is in response to the ongoing demand for our existing clinic services. Our clinic will offer members and non-members alike access to an array of healthcare services from preventative wellbeing all the way through to the treatment. Contributing to the ambition of Slaintecare, we firmly believe in the importance of delivering the right care at the right time, and that is why our clinics are open 365 days per year with consultant-led care delivered within one hour.”

Mother of three and Laya Health and Wellbeing Ambassador, Anna Daly who was onsite for the official launch of the clinic, spoke about the convenience of the urgent care service and her experience to date:

“As a laya healthcare member, it is great to see the new Laya Health Wellbeing Clinic open in Swords today featuring state of the art facilities, all of which are accessible to the local community. The Swords clinic makes it even easier to access consultant led health and wellbeing services across Dublin and the surrounding areas. As a busy mum of three young boys, I have used the Laya Health & Wellbeing urgent care clinic services in the past and was so impressed with the treatment that was received. Knowing that a patient will be seen within 60 minutes offers huge peace of mind and convenience.”

To find out more about the Laya Health and Wellbeing Clinics visit www.layahealthcare.ie

AXA announce completion of acquisition of laya healthcare

.jpg)

Welcome news: AXA announce completion of acquisition of laya healthcare

I’m delighted to share some positive news with our members. AXA has announced that it has completed its acquisition of laya healthcare from Corebridge, securing full regulatory approval and the customary closing conditions attached to the sale.

Business as usual

Please be assured that it remains very much business as usual for us at laya healthcare – there’s no change for you or the cover you hold with us. Our members will continue to benefit from the exceptional customer experience we’re committed to delivering.

With AXA’s backing, we hope to accelerate our ambitious plans for growth and to empower our members through better and faster access to world class healthcare - that is at the very heart of what we’re committed to achieving and AXA share that ambition too.

AXA – a trusted global player

This is a pivotal point in our journey at laya. By joining AXA, we are now part of a hugely successful and trusted name in insurance worldwide and our combined potential is hugely exciting. AXA has 145,000 employees worldwide serving 93 million clients in 51 countries.

Shared values and ambition

AXA’s ethos of helping their customers ‘protect what matters’ complements laya healthcare’s own mission to empower our members to look after their health and wellbeing so they can be at their very best, always. Our team are excited about today’s news – they know it will bring fantastic benefits to them and ultimately to our 690,000 members who let us look after them, always.

Thanks again for letting us look after you, and those you love.

Take care,

Dónal Clancy

Managing Director

Member Update

.jpg)

Hi All,

Some welcome and positive news.

AXA - a global and trusted name in insurance- announced that it has entered into an agreement to buy laya healthcare. This is hugely positive news that’s been welcomed with real excitement by all our team - they know it will bring fantastic benefits to our 690,000 members. It marks a major milestone in laya healthcare’s 25+ years in business and is an exciting development in our growth.

AXA’s ethos of helping their customers ‘protect what matters’ complements laya healthcare’s own mission to empower our members to look after their health and wellbeing so they can be at their very best, always.

Business as usual

While we wanted to let you in on our good news, the reality is that nothing changes for you which I know will be welcome news for you too! It remains very much business as usual at laya healthcare – you will continue to benefit from the exceptional customer experience we’re committed to delivering, and there’s no impact on the health cover you hold with us. With AXA’s backing, we hope to accelerate our ambitious plans for growth and to empower our members through better and faster access to world class healthcare.

While the agreement has been signed, the completion of the transaction will take place once the necessary regulatory approvals have been secured – expected to be sometime later this year.

Should you have any questions on our news with AXA please get in touch with us at layahealthcare.ie/contactus or give us a call.

Thanks again for letting us look after you, and those you love.

Take care,

Dónal Clancy

Laya Healthcare extends rugby sponsorship as the official Health and Wellbeing Partner of both Munster Rugby and Connacht Rugby

Laya healthcare has today announced it has it has committed to another two years as the official Health and Wellbeing partner of both Munster Rugby and Connacht Rugby.

Laya healthcare plan to continue its work with both clubs on a strategic vision that supports the performance of the provinces by focusing on aspects of health and wellbeing across the men’s and women’s teams, the backroom team, right through to the fans.

Laya healthcare's partnership with both teams underscores the company's commitment to promoting health and wellness in the communities it serves. As part of the partnership, laya healthcare will provide support and resources to both male and female teams, including access to HeartBeat Cardiac screenings for players and backroom teams.

According to Kevin Kent, Head of Marketing at laya healthcare: “Laya healthcare is extremely proud to be the official health & wellbeing partners of both Munster and Connacht Rugby since 2020 and we’re delighted today to be announcing the extension of this sponsorship until 2025.”

He added; “We have strong links to both regions with our Laya Health & Wellbeing Clinics in Galway and Limerick. The sponsorships will now further support these communities. By tapping into the positive power of sport, laya’s commitment to health and wellness will empower players and fans alike across the provinces to embrace innovative new ways to take control of their health and enjoy the benefits of a healthy lifestyle.”

Commenting on the partnership, Dave Kavanagh, Head of Commercial & Marketing at Munster Rugby, said: ““Laya healthcare has had such a positive influence on our community over the years through their steadfast support of Munster Rugby, the clubs, its players, and passionate fans. Through their support, laya contributes to the overall wellbeing and performance of the team, which plays a crucial role in helping us to stay a beat ahead and perform to the highest level. We’re delighted to continue our partnership with laya healthcare and can’t wait to see what the next couple of years will bring.”

Philip Patterson, Head of Commercial and Marketing at Connacht Rugby, added: “Laya healthcare has been a dedicated supporter of Connacht Rugby teams, our people, and our fans over the past three years. We are delighted that laya healthcare has chosen to extend its partnership with Connacht Rugby. The continued support as the title sponsor for the Laya Tag Rugby Series is also excellent news for Connacht as it goes from strength to strength each year. We are looking forward to the season ahead.”

Laya healthcare has already built strong links in both regions, with Health & Wellbeing Clinic in Limerick and Galway. Laya Health & Wellbeing Clinics offer an array of diagnostics to both laya healthcare members and non-members. The healthcare services include walk-in urgent care for the treatment of minor injuries along with video consultation for minor illnesses for patients as young as 12 months.

ENDS

For further information or to request an interview with one of the campaign spokespeople, please contact Wilson Hartnell:

- Heidi Morgan, morgan@ogilvy.com or 087 297 2046

- Cliona Plunkett, plunkett@ogilvy.com or 083 854 4925

About laya healthcare

Laya healthcare members can avail of some of the most innovative health insurance benefits and services in the Irish health insurance market along with life insurance (layalife.ie) and travel insurance (layatravelinsurance.ie). Its brand promise, Looking After You Always, represents laya healthcare’s member-centric approach, which is fundamental to its vision and values.

Laya healthcare is part of Corebridge Financial. With more than $350 billion in assets under management and administration as of June 30, 2022, Corebridge is one of the largest providers of retirement solutions and insurance products in the United States, partnering with financial professionals and institutions to help individuals plan, save for and achieve secure financial futures.

Health Insurance provided by Elips Insurance Limited (Inc. Liechtenstein) trading as Laya Healthcare. Laya Healthcare Limited, trading as Laya Healthcare and Laya Life, is regulated by the Central Bank of Ireland. Life Insurance provided by IptiQ Life S.A. (Inc. Luxembourg). Travel insurance is provided by AIG Europe S.A. (Ireland Branch).

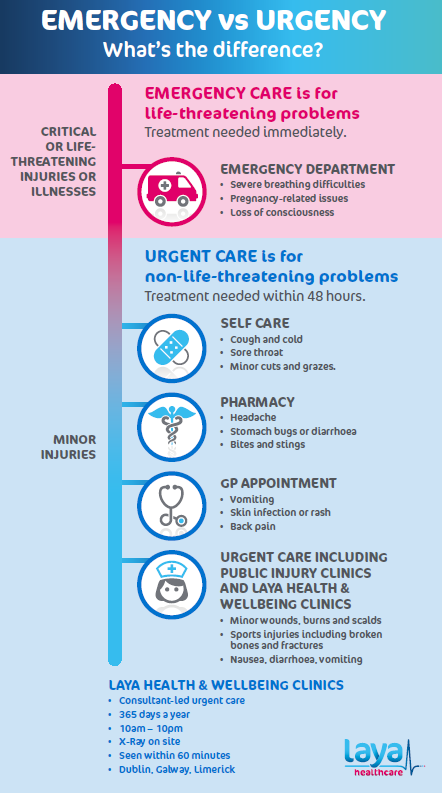

With record attendance in Ireland’s acute Emergency Departments, new research shows that over a third of visits could have been avoided*

• Research reveals a significant lack of awareness of urgent care alternatives for minor injuries and illnesses

• Almost 3 in 10 (29%)1 put off medical care in fear of long delays in hospitals, research on behalf of laya healthcare1

(2 February 2023): New research carried out in recent weeks amid the emergency department (ED) surge in acute hospitals reveals that Irish people attended their local hospital ED at least once in the past year, with average wait times of seven hours, for minor injuries and illnesses that could have been quickly and appropriately treated by their GP, pharmacist or local urgent care clinic. The survey was carried on behalf of laya healthcare.

One in three (34%)1 presented to A&E on average twice in the last twelve months for non-life-threatening minor injuries and illnesses despite alternative urgent care options being open during the time that they needed to be seen. Over 6 in 10 (61%)1 of those who presented to ED with injuries and illnesses they describe as ‘minor and non-life threatening’ attended during day-time hours 10am-10pm, Monday – Friday, at which time options such as the Laya Health and Wellbeing Clinics are open in Dublin, Galway and Limerick.

|

|

In the past 12 months, what was the reason for you attending the emergency department in your local hospital? |

% of people who visited |

|

Back pain |

24% |

|

|

Stomach pain |

18% |

|

|

Minor wound needing cleaning and/or stitches |

15% |

|

|

Suspected broken bone |

13% |

|

|

Cuts and grazes |

13% |

John McCall, Director of Claims and Provider Relations at laya healthcare says: “Our research has identified a clear gap in awareness and understanding around the huge breadth of alternatives to busy ED available in the local community. Alternatives for minor injuries and illnesses include GPs, pharmacies, public injury clinics and our own network of Laya Healthcare Health and Wellbeing Clinics where our members and non-members aged 12 months and over can be seen within 60 minutes for a range of minor injuries and illnesses including back pain, sports injuries, minor burns, nausea, diarrhoea, flu, and fever and much more. Use of these alternatives is essential if we are to reduce the burden on acute hospitals.”

McCall added, “Over 95,000 patients have been treated in Laya Health & Wellbeing Clinics since we first opened our doors in 2019, with 1 in 4 families with children accessing the service which underlines the significant ease of access and convenience the clinics offer.”

Lack of awareness of urgent care options in the community

A significant four in ten people (44%)1 are unaware of any other urgent care options for minor injuries and illnesses apart from busy EDs with this climbing to half of younger people aged 25-34 years. Only one in four (24%)1 would consider their local public injury clinic if they had a minor injury.

A perceived sense that they would be seen quicker in their local ED (43%)1 and proximity to home or work (23%)1 were the top reasons why those with minor injuries chose to go to their local hospital ED rather than avail of viable alternatives where they could be seen more quickly and appropriately.

Laya Health & Wellbeing Clinics offer an array of diagnostics to both laya healthcare members and non-members providing a viable alternative to waiting in the public system.

Delaying medical care

According to laya healthcare’s research, 3 in 10 (29%)1 admit that they have avoided seeking medical treatment due to fear of long delays in their local hospital, with half of those surveyed saying they feel “frightened” by the wait times for urgent care in Ireland.

Lauren Brand, an Urgent Care Physician who works in the Laya Health and Wellbeing Clinic in Dublin : “Education is key to reducing the burden on acute hospitals for minor injuries and illnesses that should be treated appropriately elsewhere., When people get sick or sustain an injury, they’re vulnerable and scared. We want to help, educate people on where to go for different injuries and illnesses and what the best path to care is – whether that’s self-care at home, or when to go to the local pharmacy, GP or urgent care. All these paths should be considered before heading to the ED. Of course, if the injury or illness is suspected to be serious, that’s when you should consider calling an ambulance or going to the local hospital.”

An easy service guide for urgent care

To help educate people on what urgent care option is right for different injuries and illnesses, laya healthcare has created a handy guide. This is available on the website layahealthcare.ie/clinics

ENDS

For further information or to request an interview with one of the campaign spokespeople, please contact Wilson Hartnell:

- Cliona Plunkett, plunkett@ogilvy.com or 083 854 4925.

- Heidi Morgan, morgan@ogilvy.com or 087 297 2046.

About Laya Health & Wellbeing Clinics

First established in 2019, our Consultant-led Laya Health & Wellbeing Clinics offer rapid-access ‘walk-in’ urgent care for minor injuries and illnesses from 10am – 10pm, 365 days a year. Patients from age 12months+ are seen within 60 minutes, and our urgent care services are open to both laya healthcare members and non-members (about 15% of patients seeking urgent care are non-members). Video consultations for minor illnesses are also available for adults and children as young as 12 months.

Our Clinics treat a wide range of minor injuries and illnesses including back pain, sports injuries, minor burns, nausea, diarrhoea, flu and fever and much more. For a full list of what’s treated in our clinic network go to layahealthcare.ie/clinics.

Depending on a member’s scheme, some or all of the cost of their urgent visit will be covered, including cost of diagnostics or any scans required. Laya healthcare members pay, on average, only €35 for each visit.

About the Research

Research was carried out by Empathy Research online across a nationally representative sample of n=1,000 adults aged 18+. Fieldwork was conducted from 6th – 16th January 2023.

About laya healthcare

Laya healthcare members can avail of some of the most innovative health insurance benefits and services in the Irish health insurance market along with life insurance (layalife.ie) and travel insurance (layatravelinsurance.ie). Its brand promise, Looking After You Always, represents laya healthcare’s member-centric approach, which is fundamental to its vision and values.

Laya healthcare is part of Corebridge Financial. With more than $350 billion in assets under management and administration as of June 30, 2022, Corebridge is one of the largest providers of retirement solutions and insurance products in the United States, partnering with financial professionals and institutions to help individuals plan, save for and achieve secure financial futures.

Health Insurance provided by Elips Insurance Limited (Inc. Liechtenstein) trading as Laya Healthcare. Laya Healthcare Limited, trading as Laya Healthcare and Laya Life, is regulated by the Central Bank of Ireland. Life Insurance provided by IptiQ Life S.A. (Inc. Luxembourg). Travel insurance is provided by AIG Europe S.A. (Ireland Branch).

[1] Research was carried out by Empathy Research on behalf of laya healthcare online across a nationally representative sample of n=1,000 adults aged 18+. Fieldwork was conducted from 6th – 16th January 2023.

Laya Health and Wellbeing Clinic in Galway opens new Diagnostic Imaging Suite with state-of-the-art MRI, X-ray and Dexa services

Expansion of services coincides with the second anniversary of the Laya Health and Wellbeing Clinic in Galway

- MRI, X-ray and Dexa scans are now available to patients at the Laya Health and Wellbeing Clinic in Galway – available to both laya healthcare members and non-members

- Additional services will help alleviate pressure from local hospitals and provide necessary healthcare services in the community

- Located over 3000 sq. ft. on the top level of the Briarhill Retail Complex, consultant-led care is easily accessible to members, non-members, and their families

(March 22, 2022, Galway); laya healthcare today announced the opening of a brand-new, fully functioning Diagnostic Imaging Suite, which will provide MRI, X-ray and Dexa scanning services at its Health and Wellbeing Clinic in Galway.

Available to both laya healthcare members and non-members the new diagnostic imaging services are helping to meet the increasing demand for healthcare services and provide access within a community-based setting. The additional services announcement also ties in with Laya Health and Wellbeing Clinic in Galway marking its second anniversary, which has seen over 8,000 people use the Clinic’s services since opening (1,000 of which were non-members), with footfall increasing by 58% year-on-year.

With an easy referral pathway, the new addition to the diagnostic imaging services adds to the Health and Wellbeing Clinic’s existing portfolio of advanced services, which includes urgent care with treatment typically within one hour as well as Heartbeat cardiac screenings for members over the age of 12. It also makes access to healthcare experts for laya members and the general public, much easier and quicker.

Speaking about the introduction of MRI services as part of the Clinic’s diagnostic imaging services, John McCall, Director of Claims and Provider Relations with laya healthcare, said: “The Laya Health and Wellbeing Clinic in Galway has been open for two years and has made a significant impact on the delivery of healthcare in the community. Our aim is always to put the member first and ensure they get the best care in the most appropriate setting. We are receiving great feedback from our members with high satisfaction scores and are proud to be announcing the availability of MRI services, alongside other diagnostic and screening services, such as X-ray and Dexa, delivered in partnership with Alliance Medical and our HeartBeat cardiac screening. We aim to provide a holistic member experience based on quality care and convenience and through our clinics we are delivering on this promise.”

There are currently three Laya Health and Wellbeing Clinics open across Ireland – Cherrywood, Dublin; Limerick; and Galway. By 2023, laya healthcare plans to have a network of five Clinics offering urgent care, wellbeing, and advanced healthcare services to patients nationwide. Since the first Clinic opened, over 52,000 people – of whom 15% were non laya healthcare members – have been seen across the network of three Clinics.

The Laya Health and Wellbeing Clinics are open 365 days a year from 10am to 10pm providing urgent care services within one hour for adults and children as young as 12 months. Video consultations for minor illnesses are also available.

For more information see layahealthcare.ie

- ENDS -

Notes to editors

Figures and findings from patient utilisation data.

World Obesity Day

Key research, conducted by Laya Super Troopers ahead of World Obesity Day, finds that 10% of Irish children aged between 9-12 eat fast-food takeaways more than once a week

[1]

- Ireland’s largest health homework programme, Laya Super Troopers, supports families to learn more about nutrition, mental wellbeing and physical activity.

March 3rd, 2022, Dublin: Ahead of World Obesity Day, which takes place on Friday, March 4th, new research commissioned by Laya Super Troopers, Ireland’s largest health homework programme, which is endorsed by Healthy Ireland, found that nearly one in 10 children are eating fast-food takeaways more than once a week. During COVID-19, 45% of parents surveyed said that they consumed more fast-food takeaways as a family. (1)

The research also found that high-fat salt and sugar foods were also being consumed regularly by Irish children with 63% of children eating chocolate more than once per week and just under half of children (48%) eating crisps more than once per week.(1)

Over half of parents surveyed believe their child is not educated enough on nutrition and 32% said they would like to teach their children to cook but don't know where to start. Four in five children aged 9-12 (80%) can make a sandwich, but only one in three (33%) can cook an egg.

The national research was carried out as part of laya healthcare’s Laya Super Troopers TV, a free 28-part TV series, which aims to provide families and children with fun activities and advice on how to promote a healthier lifestyle for all the family. The series features standalone episodes and is available on demand enabling families to watch their favourite episodes at any time.

Within Laya Super Troopers TV, parents can find healthy recipes and nutrition tips to help support them in creating healthier nutrition habits for their kids and all the family.

Di Di Zwarte, registered dietician, who took part in Laya Super Troopers TV said: “It is not always easy for parents to pick the most nutritious foods with busy lives and the amount of unhealthy foods available around us. Healthy habits are formed when children are young – this also applies to nutrition. Food needs to be introduced in a way that appeals to children and that can be easily integrated into the family routine.

“The research highlights that almost nine in 10 (89%) parents of children in this age group, agreed that teaching your children to cook is a great way to bond with them. Unfortunately, this same percentage also shows that children are drinking fizzy drinks, fruit juices and flavoured waters weekly or more than once a week, and nearly half of these children are drinking them daily. (1) This shows the need for educating our families and children on nutrition and what they should and shouldn’t be drinking and eating. The Laya Super Troopers TV series is meeting this need and is an excellent resource that contains easy to follow recipes and healthy nutrition tips for families to help support them start their healthy habits.”

The research also revealed that almost half (47%) of parents of children aged 9 to 12 years old believe that having access to too many unhealthy food options is a barrier to maintaining a balanced diet for their child.1 When asked about their child’s diet and the impact COVID-19 had, almost a quarter (23%) of parents of children in this age bracket, believe COVID-19 negatively affected their child’s diet, with two-thirds of children, whose parents took part in the research, reportedly snacking more during lockdowns.1

According to Sinéad Proos, Head of Health and Wellbeing at laya healthcare, the research results show how parents and families are in need of support to promote and maintain a healthy family lifestyle. “We are now post-pandemic and it is an opportune time for parents to take stock of their family’s diet and nutrition habits and see where simple changes can be made. Our research findings highlight the importance of teaching our children during their early formative years about the importance of good nutrition choices and habits they can then carry into their adult years. What we have tried to do through Laya Super Troopers TV is meet this need head on by sharing simple and engaging ways for children and families to build healthy habits into their lives, including fun tips and hacks when it comes to making healthy eating easy and interesting. We encourage all families to tune in.”

Families across the country can get involved and find healthy recipes by going to layasupertroopers.ie, where they can also access the free Laya Super Troopers TV series or to register their schools.

ENDS

For further information please contact Wilson Hartnell:

Emma Costello, Tel: 087 358 8596, or email emma.costello@ogilvy.com

Shauna Rahman, Tel: 087 705 6293, or email shauna.rahman@ogilvy.com

Notes to editors

Online resources

A healthy recipe from Laya Super Troopers TV easy for all the family to make:

Egg Muffins

1. Cut up some of your favourite vegetables for example peppers, courgettes, carrots, etc.

2. Add the vegetables to a microwaveable bowl and cover with cling film. Heat in the microwave for two minutes.

3. In a large bowl beat six eggs together. Once beaten add in the microwaved vegetables. You can also add in some cheese.

4. When it’s all mixed together pour into a muffin tin with six holes. Bake in the oven at 200 degrees Celsius for 15 – 20 minutes. Enjoy!

The research

Research was conducted through an online survey across a nationally representative sample of 400 adults aged 18+ with dependent children aged 9 to 12 years old. Quotas were placed on gender, age, social class and region with weighting applied to ensure final data was representative of these quotas. The research shows that there was over 260,000 children in this age bracket in Ireland.

Fieldwork was conducted from August 21st-29th, 2021 inclusive. The sample size of 400 results in a margin of error of +/- 5.2%.

[1] Research undertaken by Empathy Research on behalf of laya healthcare, online survey of 400 adults aged 18+ with children aged between 9 – 12; August 2021.

Stars Johnny Sexton and Anna Geary launch Laya Super Troopers TV as new in-depth research reveals that 68% of children aged 9-12 experience anxiety

- Laya healthcare has released the results of a national research study examining the health and wellbeing of children aged 9-12 in Ireland

- The findings reveal that nearly 7 in 10 children aged between 9 - 12 experience anxiety with only one third of parents describing their child as happy and carefree all the time[i]

- Only 4 in 10 children are getting adequate levels of physical activity per day and 5% of children aged 9 -12 are not exercising on a daily basis[i]

- Three quarters (76%) of parents of children claim they would like to see more of their child's current homework being focused on learning about nutrition and physical and mental wellbeing

- World premiere of Laya Super Troopers TV held in Dublin national school is hosted by Anna Geary and attended by Irish rugby star Johnny Sexton

- Endorsed by Healthy Ireland, the Laya Super Troopers programme has benefitted more than one million children since its launch in 2014

Dublin, 15th September 2021: Laya healthcare has today released the findings of a national research study examining the overall health and wellbeing of children aged 9 – 12 in Ireland. The study explores the status of the physical, nutritional, and mental health of children and ‘tweenagers’ and aims to highlight the areas where parents and families are most in need of support and information. The results were revealed as laya healthcare hosted the world premiere of Laya Super Troopers TV, the newest element in the established Super Troopers health homework programme. The children of St. Benedict’s and St. Mary’s national school in Raheny took part in an exclusive screening of the first episode in the 28-part series that aims to provide families and children with fun activities and advice on how to promote a healthier lifestyle for all the family.

The results of the nationally representative study reveal the reality of the mental health and wellbeing of the children of the nation. Of the parents surveyed, 68% claim that their child experiences anxiety and can go through periods of low mood, with 4% describing their child is very anxious and in need of reinforcement.i This situation for families has been further compounded by COVID-19 as 40% of parents report that pandemic has had a negative impact on their child’s mental health and 57% of parents claim that their child gets upset more easily now than they did before its onset.i

The importance of physical exercise and the positive impact it has on their child’s mental health is widely recognised by parents, with 87% saying that their child is noticeably happier after taking part in physical activity.i Despite this, the study findings reveal that more than half (58%) of children aged between 9 – 12 are not getting the recommended one hour of daily physical activity.i This represents a steep decline in activity levels amongst children of the same age group from 2018 when 51% of children were getting more than an hour of activity per day.[ii]

The parents surveyed recognised that nutrition and diet remains an area with an unmet need for parents in terms of support and information, as 47% of parents claim that their children have access to too many unhealthy food options, and one third of parents saying that they would like to teach their children to cook but do not have the tools or information to know where to begin.i

Laya Super Troopers TV

The research findings were released as laya healthcare launches a 28-part TV series – Laya Super Troopers TV – as the newest element of the established health homework programme. The series, which features stars such as Johnny Sexton, Anna Geary and Karl Henry alongside well-known personalities, sportspeople and health and wellness experts, focuses on nutrition, physical activity, and mental wellbeing. Hosted by child presenters MJ Kearin (12), Daniel Shields (14) and Juliet McKenna (12), the Laya Super Troopers TV episodes are available to everyone and feature an array of fun activities, advice, and lots of challenges for children, parents and teachers to do themselves.

Endorsed by Healthy Ireland, the Laya Super Troopers programme has benefitted more than one million children since its launch six years ago and 600 schools will take part in the programme this academic year. As Ireland’s first health homework initiative Laya Super Troopers encourages children and families to integrate achievable yet impactful activities into their daily lives. Hosted by children, Laya Super Troopers TV is a fun and engaging series that provides viewers with tips and activities that can help promote a healthier lifestyle for all the family.

Irish rugby star and Laya Super Troopers ambassador Johnny Sexton commented at the launch of the TV series: “Healthy habits are formed when children are young, but they need to be introduced in a way that appeals to them and that can be easily integrated into the family routine. It has been so great to take part in Laya Super Troopers TV and contribute to a programme that also provides parents with support to help nurture the physical and mental wellbeing of their children. I’m really looking forward to tuning into the episodes with my own kids as I am sure they are going to love it.”

More startling results from the report show that almost a quarter of parents (24%) of children aged between 9 – 12 claim that they do not have adequate knowledge or understanding to ensure that their children are getting adequate levels of physical activity on a daily basis.i Three quarters (76%) of parents of children claim they would like to see more of their child's current homework being focussed on learning about nutrition and physical and mental wellbeing rather than it all being academically focussed on core subjects such as English, Irish and Maths.i

Sinéad Proos, Head of Health and Wellbeing at laya healthcare commented. “As the results of the research study show, parents and families are in need of support so that they can begin forming the habits that can lead to a healthy lifestyle. It is not just a matter of getting out for more physical activity, the mental and nutritional health of children is equally as important. What we have tried to do through Laya Super Troopers TV is meet this need head on by sharing simple and engaging ways for children to help manage their mental wellbeing, learn more about healthy eating, and build activity into their daily schedule. It is something that we are hugely proud of and that we are sure will positively impact the health and wellbeing of children across the country.”

Impact of COVID-19

84% of parents reported an increase in screen time for their children as a result of the pandemic – this figure rises to 88% amongst the parents of children who engage in less than an hour’s physical activity per day.i Similarly, there has been an increase in time spent on social media, with 80% of parents saying their child has been spending more time on TikTok, Facebook or Instagram over the past 18 months.i

Diet and nutrition is another area in which parents have felt the pressure of COVID-19 and have seen an impact on their children’s health. Almost a quarter of parents (23%) claim that the pandemic has resulted in a disimprovement in their children’s eating habits with 74% of parents seeing an increase in snacking, and 51% saying it was harder to say no to children when they asked for treats or less healthy food options.i 45% of parents also acknowledged that they were eating more takeaways as a family over the past 18 months.i

Commenting at the launch of Super Troopers, Frank Feighan TD, Minister of State with responsibility for Public Health, Well Being and the National Drugs Strategy, said:

“Encouraging families to get involved with their children’s health and wellbeing is critically important for the future health of our nation. Laya Super Troopers is a clever way to get kids more active with their families and involving teachers in overseeing health homework and is a great way to ensure that health and wellbeing is a focus in homes and schools every day.

The programme also focuses on the three main strands of our work in Healthy Ireland; physical activity, emotional wellbeing and a healthy diet. It's great to see these healthy habits being encouraged at a young age and I’d encourage more schools to get involved and support making these habits last a lifetime; helping to bring about a Healthier Ireland for the adults of tomorrow."

Families all across the country can get involved by going to layasupertroopers.ie to access the free Laya Super Troopers TV series or to register their schools.

The first episode of Laya Super Troopers TV launches on Monday 20th September at layasupertroopers.ie.

ENDS

For further information please contact Wilson Hartnell:

Dernagh O’Leary, Tel: 083 391 1504, or email: dernagh.o’leary@ogilvy.com

Marie Lynch, Tel: 087 973 0522, or email: marie.lynch@ogilvy.com

Notes to editors

Research was conducted through an online survey across a nationally representative sample of 400 adults aged 18+ with dependent children aged 9 - 12. Quotas were placed on gender, age, social class and region with weighting applied to ensure final data was representative of these quotas.

Circa 14% of adults have a dependent child in their household aged 9-12. This equates to a total universe of n=260,082 children aged 9-12 in the Republic of Ireland.

Fieldwork was conducted from 21st – 29th August 2021.

The sample size of 400 results in a margin of error of +/- 5.2%.

[i] Research undertaken by Empathy Research on behalf of laya healthcare, online survey of 400 adults aged 18+ with children aged between 9 – 12; August 2021.

[ii] Research undertaken by Empathy Research on behalf of Laya Healthcare.

Brown Thomas Arnotts, Aon and Laya Healthcare recognised for commitment to diversity and inclusion

Luxury retailer Brown Thomas Arnotts, global insurance firm Aon, and Laya Healthcare are amongst the latest companies to receive accreditation from the Irish Centre for Diversity for their commitment to equality, diversity and inclusion in the workplace.

The Irish Centre for Diversity runs the ‘Investors in Diversity Ireland’ initiative, Ireland’s first and only all-encompassing equality, diversity and inclusion mark. The initiative is supported by Ibec and the DCU Centre of Excellence for Diversity and Inclusion. Companies that join the initiative are provided with a framework that offers tools to measure and improve their diversity and inclusion (D&I) policies and practices, whilst also recognising their efforts through accreditation at Bronze, Silver and Gold levels.

Brown Thomas Arnotts received Bronze accreditation in recent weeks, having successfully demonstrated it has effective D&I policies in place; effectively communicates these policies to all staff; and provides D&I training for all company leaders.

Laya Healthcare and Aon, meanwhile, have both achieved Silver accreditation, which – on top of the requirements for the Bronze level – entails a staff-wide survey to measure the culture and embedding of best-practice D&I measures in the workplace.

Brown Thomas Arnotts, Laya Healthcare and Aon are joined by the likes of AIB, Matheson, Bank of Ireland, Enterprise Ireland, Pramerica, Irish Rail, the HSE and Three as participants in the ‘Investors in Diversity Ireland’ initiative.

Commenting today (08.09.20), Caroline Tyler, Director of the Irish Centre for Diversity, said: “We launched ‘Investors in Diversity Ireland’ in 2019, and we now have companies across a wide range of industries participating in the initiative, with demand from interested organisations growing month by month. Participants range from well-known consumer brands to state agencies, and from SMEs to global firms.

“They are all at different levels of their D&I journey. Some are just starting out, and are working towards achieving our Bronze accreditation, while others have deeply embedded and effective D&I strategies in place, and are working with us to measure the effectiveness of those strategies, and to truly embed D&I within their business. Laya Healthcare was one of our first corporate partners, for example, and has worked with us in a very proactive way over the past 18 months. In addition to advancing diversity and inclusion in their own organisation they are also offering our diversity and inclusion training to their corporate clients.

“2020 has been a particularly interesting year for our work. It has been good to see that, even in the face of Covid-19, companies are continuing to devote time and resources to ensuring they promote and embed diversity and inclusion.

“Alongside Covid-19, however, 2020 has also witnessed the growing prominence of the Black Lives Matters movement, and – in some parts of the world – growing discrimination against people of colour and LGBTI+ people. These global trends are, of course, impacting on Irish workplaces – employers are increasingly conscious of the need to meaningfully embed D&I in their organisations. Companies are being held accountable by their staff; they are asking the question, ‘What are we doing to ensure fairness for all in our organisation?’. Embedding best-practice D&I policies and actions is not just the right thing to do; it’s also expected by customers, suppliers and employees.”

Donald McDonald, Managing Director of Brown Thomas Arnotts, said: “We are incredibly proud to receive Bronze accreditation from the Irish Centre for Diversity. We pride ourselves on being an inclusive and dynamic workplace. We know that – by embracing different perspectives, welcoming different voices, and leveraging our collective strengths – we will become the best workplace we can be.”

ENDS

Contact: Ciarán Garrett / Sorcha MacMahon, Tel: 087-7158912 / 087-7585337, Email: media@alicepr.com

Notes to Editors:

The Irish Centre for Diversity’s aim is to work in partnership with organisations across Ireland to help them embed equality, diversity and inclusion in all they do. The Centre’s services include the ‘Investors in Diversity’ accreditation, Ireland’s first all-encompassing diversity and inclusion mark, offering a holistic approach to improving equality and diversity across all grounds; and the ‘Equality Ireland’ annual directory, which highlights employment opportunities and services to the diverse communities of Ireland. Further information is available at: www.irishcentrefordiversity.ie, or by following the Centre on social media:

Negative impact on physical and mental wellbeing of Irish workers under Covid-19 highlighted in national research

KEY FINDINGS: