Lifetime Community Rating (LCR)

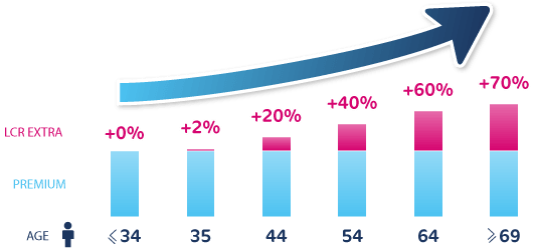

After 30th April 2015, if your employees are over the age of 34 when they first take out health insurance, they will have to pay extra for their cover. It works out at an extra 2% loading for each year above 34, up to a maximum of 70%. This loading can be applied to a premium for a maximum of 10 years.

However, if they are already a laya healthcare member LCR will not affect them so they have nothing to worry about.

What you need to know about the impact of Lifetime Community Rating (LCR):

-

Rest assured, employees that hold health insurance when LCR is introduced have nothing to worry about–it will not affect them.

-

We are updating our corporate reporting system to reflect all implications of LCR so there will be no impact on our processes with you post 30th April 2015.

-

We can accommodate different payment models depending on how you wish to handle potential loadings for your employees post 30th April 2015 i.e. if you want to pay the loading on behalf of your employee or you want to allow your employee pay for the loading in full themselves.

-

Please remember to encourage any of your employees over the age of 34 who do not hold health insurance to purchase it no later than 30th April.

Cost of health insurance premiums for new subscribers after 30th April 2015

Possible scenarios facing employers post 30th April:

Scenario 1:

A company hires a 45 year old who has not held health insurance in the past. His loading is 11 years at 2% = 22%. He has no credits to reduce his loading.

What are the payment, BIK and Tax Relief at Source (TRS) implications if any?

- Employer pays LCR loading:

There are no implications on the TRS amount. The employees BIK will be calculated on the gross rate. However the gross rate will now include the LCR loading, in this case 22%.

- Employee pays LCR loading:

TRS is split proportionally between the employer and employee as it is assumed that the premium is inclusive of the LCR loading. The employee’s BIK is calculated on the gross rate of the premium paid by the employer, and the employee is liable to pay the applicable loading.

Scenario 2:

A company hires a 38 year old who must move to Ireland from abroad to take up the position. She moves to Ireland on 17th May (post LCR introduction).

- She takes our health insurance within 9 months of moving to Ireland –she/her employer is not liable for any LCR loading.

- She waits 9 months to take out health insurance. An LCR loading will be applicable to her premium and must be covered either by her/her employer as she is outside the grace period for the overseas waiver.

Our LCR expert Seán can tell you more about how things will change after 30th April, click below!